Tax with SAP S/4HANA Configuration and Determination

ISBN 978-1-4932-2245-2 506 pages, 2022

E-book formats: EPUB, PDF, online

ISBN 978-1-4932-2246-9 506 pages, 2022, Print edition hardcover

E-book formats: EPUB, PDF, online

ISBN 978-1-4932-2247-6

- Configure SAP S/4HANA for direct and indirect taxes with step-by-step instructions

- Prepare your system for global finance, procurement, and sales tax operations

- Master key tax reporting and monitoring functionality

In this book, you’ll learn about:

-

Configuration

Tailor tax settings to your exact specifications. Learn how to customize standard settings for financial accounting, sales and distribution, and materials management.

-

Direct and Indirect Taxes

Walk through tax determination, step by step. Set up indirect tax determination for purchasing, sales, and special processes. Learn about the direct tax process and configure key settings for ledgers, withholding tax, general ledger accounts, and more.

-

Reporting and Monitoring

Understand your reporting and monitoring requirements. Explore standardized tax reporting, see how tax monitoring fits into the tax control framework, and use solutions like SAP Document and Reporting Compliance and SAP Tax Compliance.

Highlights include:

-

Organizational structure

-

Configuration

-

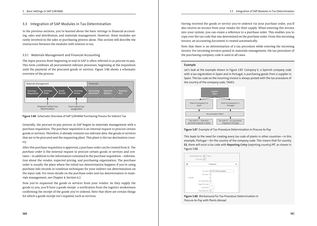

Indirect tax determination

-

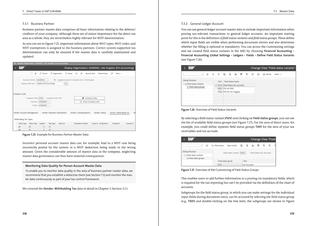

Direct tax

-

Condition logic

-

Tax reporting

-

Tax monitoring

-

User exits

-

Tax engines

You may also like:

-

Configuring SAP S/4HANA Finance

738 pages, hardcover

Get your SAP S/4HANA Finance configuration right the first time! Whether you’re running a new implementation or transitioning from SAP ERP, this comprehensive guide walks you through each project task. Start by setting up an organizational structure and defining global … More about the bookfrom $84.99

Available

E-book | Print edition | Bundle -

Business Partners in SAP S/4HANA –

The Comprehensive Guide to Customer-Vendor Integration353 pages, hardcover

The distinction between “customers” and “vendors” is now a relic of the past—jump into the future with this all-in-one guide to business partners in SAP S/4HANA! Learn how to set up business partners from start to finish for greenfield implementations. … More about the bookfrom $84.99

Available

E-book | Print edition | Bundle -

Financial Reporting with SAP S/4HANA

707 pages, hardcover

Having access to clear, accurate financial reports is key for any organization! In this comprehensive guide, you’ll walk step by step through creating such high-quality reports in SAP S/4HANA. You’ll learn about key reporting requirements for finance and how to … More about the bookfrom $84.99

Available

E-book | Print edition | Bundle